In the spirit of financial inclusion and Bayanihan, leading finance app GCash has expanded its relief program ‘Tulong Mo I-GCash Mo’ to mobilize the support of Overseas Filipinos (OFs) amidst the disaster brought about by Typhoon Carina. The relief program allows Filipinos worldwide to send financial help to relatives and loved ones, and donations to non-government organizations (NGOs) through the GCash app.

For its part, GCash is temporarily waiving selected transaction fees for disaster recovery.

“GCash is empowering Filipinos worldwide to embody the nation’s core value of Bayanihan – the spirit of communal unity, especially in these trying times. Through GCash, Overseas Filipinos can swiftly extend a helping hand to loved ones affected by calamities such as Typhoon Carina or contribute to relief efforts. To foster this sense of solidarity, GCash, through its global partners, are waiving select transaction fees for its users, making it easier and more affordable to cash in, send aid, and support those in need.”

Paul Albano, GCash International General Manager

Filipinos from 14 countries with GCash Overseas accounts can directly donate to NGOs like the Red Cross, Ayala Foundation, Save the Children, and more via the app’s Bills Pay section without incurring fees.

Aside from this initiative, GCash also enables OFWs to easily access convenient digital financial services and solutions anywhere in the world. In the US, GCash users can cash in for free from their US bank accounts for their first two transactions until July 31. Participating institutions include Bank of America and Wells Fargo.

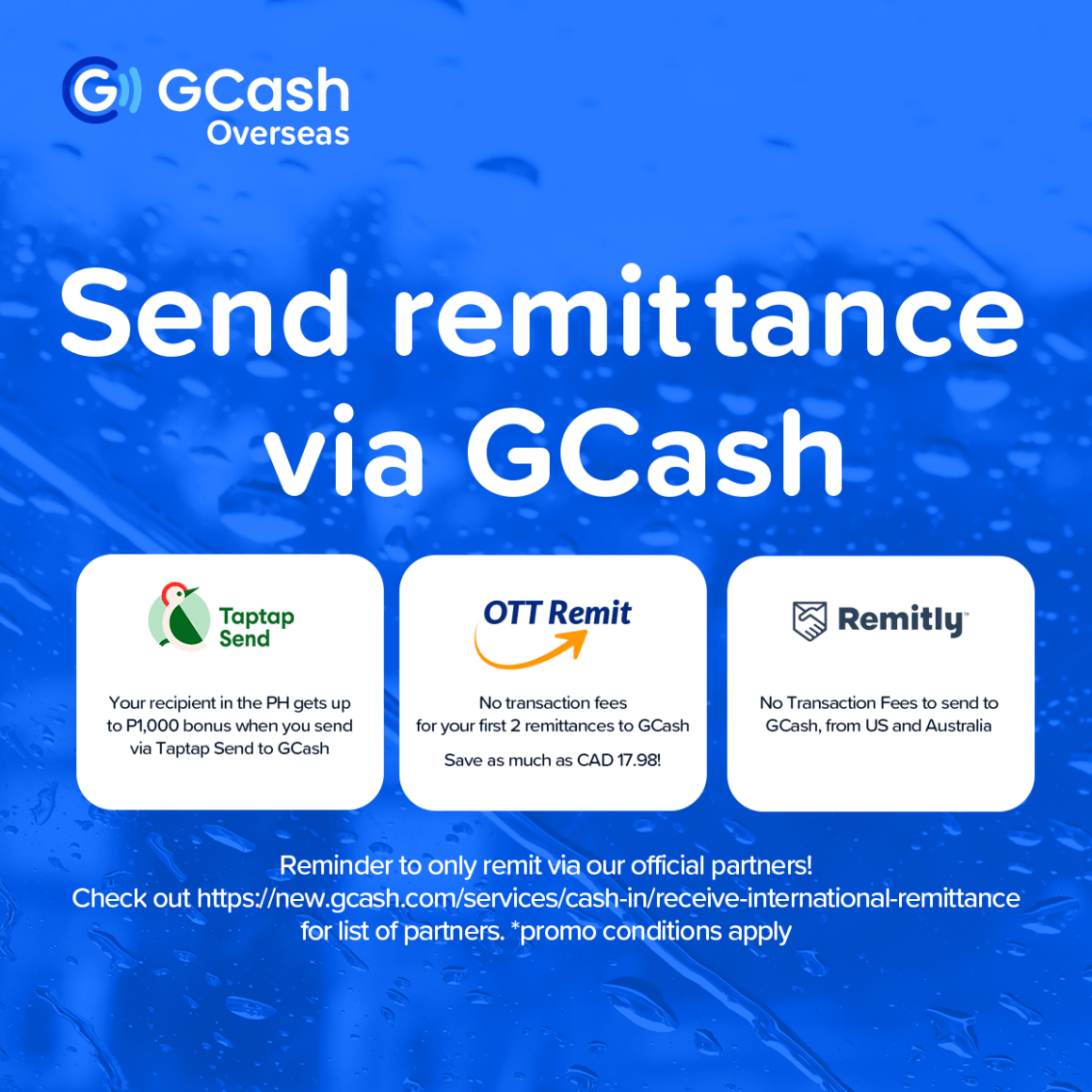

In Canada, users can cash in via OTT Remit with no fees for their first two transactions when transferring to their GCash Overseas account or sending to a GCash account in the Philippines, potentially saving up to CAD 17.98.

To offer OFWs seamless remittance, GCash adds more global partners including Taptap Send, allowing residents in the Philippines to receive a bonus of up to PHP 1,000. Remitly, another global remittance partner of GCash, offers no transaction fees for transfers from the US and Australia.

OFWs in other countries may cash in and remit to GCash via Payoneer, Western Union, Moneygram and other GCash accredited partners.

Leave a Reply