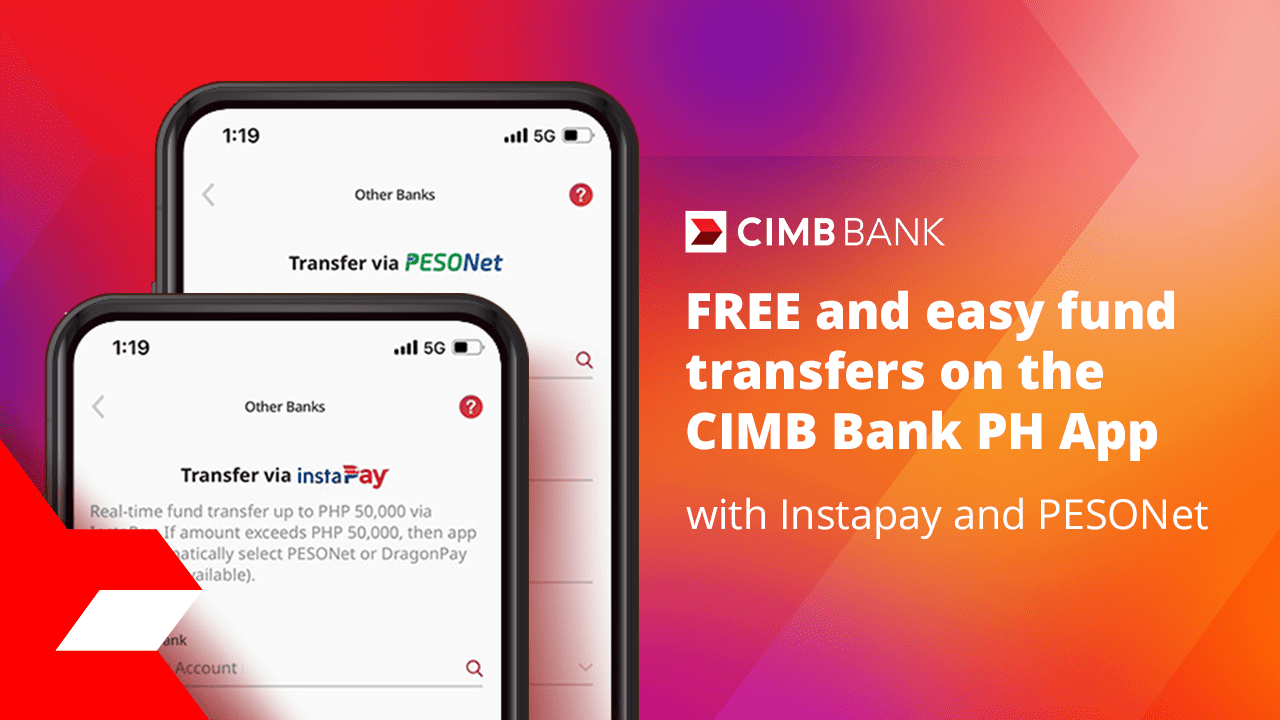

Leading digital banking services provider CIMB Bank Philippines now offers InstaPay on the CIMB Bank PH app. Users can now easily transfer as much as PHP 50,000 to and from their CIMB savings accounts with no delays and at no cost.

With this, CIMB customers can now enjoy the following features:

- FREE transfers. CIMB does not charge any fees for all InstaPay transfers.

- Real-time and available 24/7. Through InstaPay, CIMB customers can easily transfer and receive funds using their CIMB accounts at any time of the day. There are no cut-offs and wait-times, but both senders and receivers must also be a participating InstaPay institution to enjoy instant transfers.

- Send and receive from various multiple banks and e-wallets. With InstaPay, CIMB customers can send or receive funds from over 60 participating banks and e-wallets.

- Convenient and hassle-free. There is no need to physically go to a bank to perform the transfer. InstaPay transfers can be made entirely from mobile phones using the CIMB Bank PH app.

“Committed to support the BSP’s drive to facilitate greater adoption of digital transactions, we are excited to finally have InstaPay on our platform. Our 6 million CIMB customers can now use it to transfer funds for free and in real-time, giving them more control over their finances,” shares CIMB Bank Philippines Chief Executive Officer Vijay Manoharan.

With the addition of InstaPay, CIMB customers can opt to transfer funds on the CIMB Bank PH using either InstaPay or PESONet. Transfers to participating banks and involving amounts up to PHP 50,000 may be done through InstaPay. On the other hand, transfers involving amounts exceeding PHP 50,000 or banks who are not participating InstaPay institutions can be done via PESONet for free as well.

Learn more about CIMB’s free InstaPay transfers here. To learn more about CIMB Bank PH, visit www.cimbbank.com.ph.

Leave a Reply