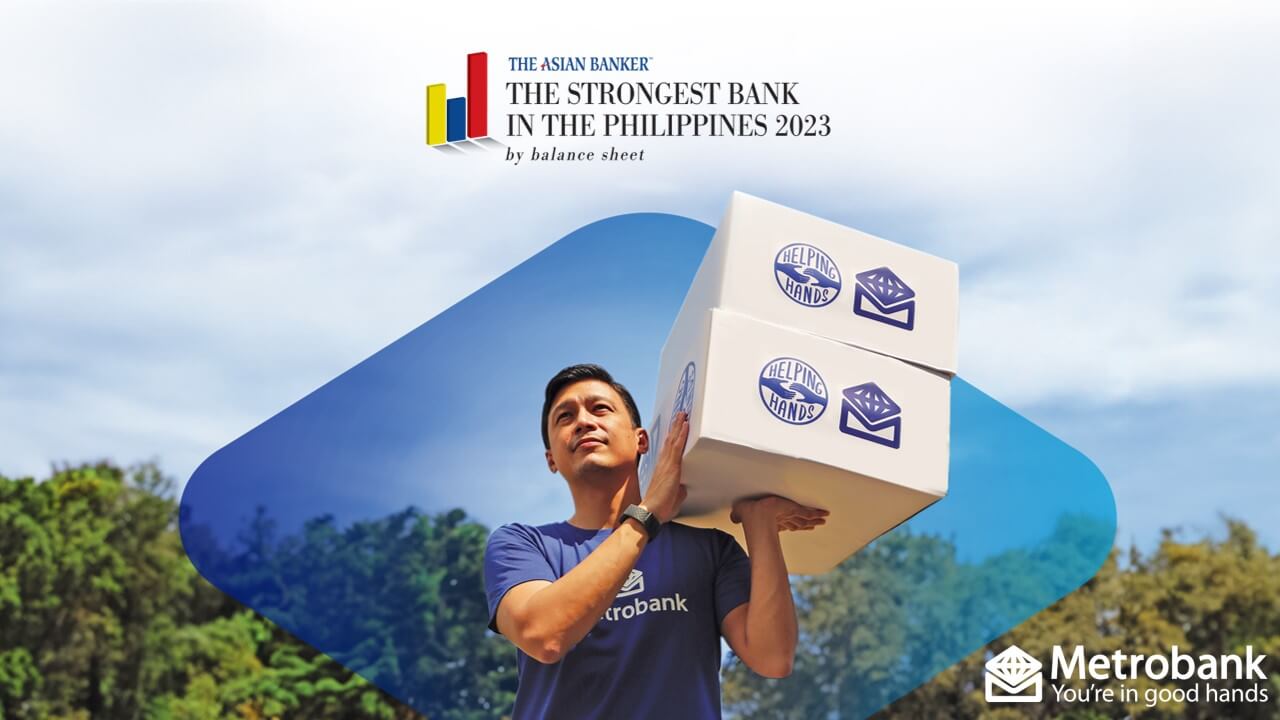

Built on trust, Metropolitan Bank & Trust Co. (Metrobank) has been recognized as the Strongest Bank in the Philippines by The Asian Banker for the third straight year and the Best Domestic Bank in the country by Asiamoney. This attests to the Bank’s strength and reliability in putting its clients in good hands.

The Bank gained these prestigious international recognitions from The Asian Banker and Asiamoney for its consistently strong financial performance across the board. In the first half of 2023, Metrobank maintained a strong 34% growth in net income of PHP20.9 billion, fueled by the Bank’s expanding assets, enhanced margins, and robust fee income growth; while sustaining a stable asset quality.

On top of these awards, the Bank was also listed by TIME Magazine and Statista as one of the World’s Best Companies. The “World’s Best Companies 2023”, is a comprehensive list that ranks top performing companies across the globe based on employee satisfaction, revenue growth, and sustainability (ESG).

“We’re honored to receive these back-to-back recognitions, especially as we celebrate the Bank’s 61st anniversary. At Metrobank, we always strive for excellence — whether it be in addressing our clients’ needs, achieving exceptional financial performance across our business, or contributing to nation-building. These awards are testaments to the steadfast commitment and relentless drive of each Metrobanker to keep Filipinos in good hands,” said Metrobank President Fabian Dee.

Reliable partner throughout every Filipino’s financial journey

For decades, Metrobank served as a reliable partner for Filipinos throughout their life journey – providing them with financial services and guidance that are tailor-fit to their needs, even as they now navigate a modern and digital world. But before offering them a product or a service, every Metrobanker ensures that their clients fully and clearly understand the financial products and services they will avail of.

The Bank’s mission to enable Filipinos throughout their financial journey goes beyond simply offering relevant solutions. Despite its financial success, the Bank’s priority and advocacy is to educate Filipinos first as they step into their financial journey. This is to make sure that every client makes a fully-informed financial decision and knows how to protect themselves against fraud. This is made evident through Metrobank’s sustained financial education efforts– designed to equip Filipinos with reliable financial advice, fit for every life stage.

In 2022, Metrobank introduced a comprehensive personal finance e-book developed to help Filipinos to become financially resilient. Meanwhile, the Bank’s Earnest app aims to simplify investing, through bite-sized lesson cards and easy-to-understand articles that cover basic investing concepts. For more advanced investors, there is Wealth Insights, an online portal that contains publicly accessible market-moving news and insights, as well as exclusive premium content that includes bespoke articles which dive deep into timely and actionable investment ideas. Meanwhile, Metrobank provides its clients with regular reminders and guidance to protect themselves against fraudulent transactions via SMS, emails, and social media posts.

Today, Filipinos can easily start their financial journey by going to Metrobank’s hundreds of branches nationwide or digitally via the Earnest app. Those aiming to further grow their funds through investments can do so with Metrobank’s Online Time Deposit, which offers an interest rate of up to 4.5%, or through Metrobank’s wide-range of unit investment trust funds (UITF).

With its commitment to give customers a safe, simple, and secure experience on the NEW Metrobank app, the Bank recently introduced its interoperable QR feature, which allows on-the-go clients to enjoy more convenient fund transfers to and from other banks and e-wallets.

Meanwhile, clients who are ready for a life upgrade – be it a new car or their dream home, can avail of Metrobank’s home and car loan offers with affordable rates and flexible payment terms.

Growth partner for businesses

Metrobank’s services transcend from customers to enterprises. When Metrobank was founded in 1962, it was primarily built to be a bank for businesses. Over six decades later, the Bank continues to stay true to its roots by offering a full suite of best-in-class financial solutions designed to serve enterprises of all sizes – from SMEs to large corporations based here and abroad.

As a growth-enabler, Metrobank fuels the operational expansion of various businesses through its competitive lending rates, coupled with dedicated and dependable Metrobankers that cater to their needs. The Bank also provides these enterprises with solutions, such as the Metrobank Business Online Solutions (MBOS), Point-of-Sale terminals, Payroll, and Trust Banking, that help them manage their cash flow better, accept cashless payments, disburse salary to employees, and even grow their funds through investments, among many others.

With its end-to-end financial solutions for enterprises, backed by decades-worth of exceptional track record on its service, Metrobank remains to be the best partner for promising businesses in the Philippines.

Responsible partner of the community

While Metrobank serves as a reliable and stable financial partner for individuals and businesses, it also takes an active role in nation-building. Through the Metrobank Foundation, the Bank supports programs focusing on health, education, arts, livelihood, as well as honoring outstanding individuals in society.

Metrobank Foundation and GT Foundation recently turned over PHP40 million worth of development grants to 32 partners during the recent George S.K. Ty Grants Turnover ceremony. This year’s assistance aims to support interventions that would address malnutrition, ensure access to quality education, fuel creative communities, and promote sustainable livelihoods, among others.

Meanwhile, Metrobank Foundation has also announced the new batch of 10 Outstanding Filipinos, composed of teachers, policemen, and soldiers, who went beyond their call of duty to be of service to others. Through this flagship program, each recipient of the career service award received a PHP1 million cash prize (net of tax), a golden medallion, and “The Flame” trophy.

“All these are signified by our promise, You’re in Good Hands. This promise manifests not only in our banking business, but also across the advocacies that we support,” said Mr. Dee

Leave a Reply